- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

The major provisions of the FLSA are concerned with minimum wage rates and overtime payments, child labor, and equal rights. The US Department of Labor, Wage & Hour Division, oversees federal labor laws. Additionally, State DOLs administer state labor laws. Failure to comply with Wage & Hour laws may result in the employer paying the employee back wages, damages, penalties, attorney fees and court costs, plus the prospect of civil and criminal penalties from federal and/or state governments. Therefore, Wage & Hour compliance is of the utmost importance.

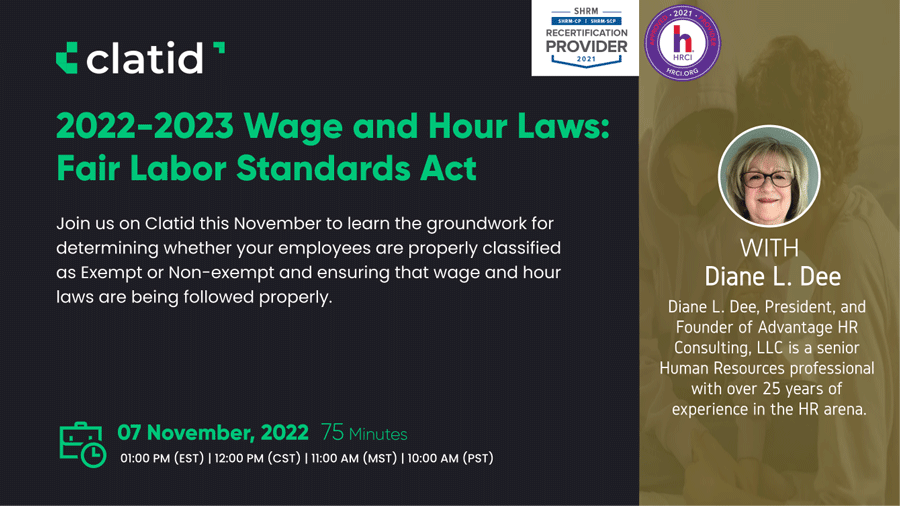

Join us on Clatid this November to learn the groundwork for determining whether your employees are properly classified as Exempt or Non-exempt and ensuring that wage and hour laws are being followed properly.

-The Fair Labor Standards Act

-The six FLSA exemptions

-Exempt vs. Non-Exempt status

-Salary Level and Salary Basis tests

-Anticipated changes to FLSA in 2022

-Repercussions of FLSA non-compliance

-What are the tests used to determine if an employee is exempt from FLSA?

-Why is determining the primary duty of a job so important?

-How to determine when to pay overtime?

-How to calculate overtime pay?

-What are the minimum wage provisions under FLSA?

-What are the equal pay provisions under FLSA?

-What are the child labor regulations?

-What are the recordkeeping requirements?

-Human Resources Professionals

-Compensation Professionals

-Compliance professionals

-Payroll professionals

-Managers & Supervisors

-Employees

Diane holds a Master Certificate in Human Resources from Cornell University’s School of Industrial and Labor Relations and has attained SPHR, SHRM-SCP, sHRBP, and HRPM® certification.

Diane is a member of the National Association of Women Business Owners and the Society for Human Resource Management. Additionally, Diane performs pro bono work through the Taproot Foundation, assisting non-profit clients by integrating their Human Resources goals with their corporate strategies.

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.25 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Clatid Webinar Certification - Clatid rewards you with Clatid Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Clatid Courses and Webinar or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Clatid doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!