- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

Oftentimes, some unwitting taxpayers and practitioners overlook the importance of gift tax returns. So the IRS Form 709 can be left unfiled. In this webinar, you will get an understanding of the reporting requirements and we will provide the preparation tactics that influence the process.

We will highlight the strategies that can be used to mitigate and, in some instances, even eliminate a tax that currently can take as much as a 40% bite from gratuitous transfers will be examined, along with looming legislative changes that threaten to upend planning for wealth transfers.

Join us this June to learn when these returns are due and how you can prepare them.

-What are the filing requirements for Form 709?

-How do we prepare Form 709 line-by-line?

-Who is liable for the tax?

-How does the gift tax relate to the estate & GST tax regimes?

-What tax code changes can we expect?

-What's the split gift compliance?

-Why is gift tax imposed?

-How and when can you file to extend your income tax return?

-What taxpayer details are required?

-What's the process of tax calculations?

-What are the tax rates for 2021?

-What could go wrong if you ignore it?

-Where comes the cumulative tax?

-Is there a way we can still pay less?

-Categorize which gifts are subject to tax

-Identify the three elements that make a gift a “gift”

-Understand the difference between the gift tax exemption and the exclusion

-Employ special rules provided for by the gift tax regime that apply to donor spouses, non-resident aliens, and expatriates

-Join the experienced professional to complete the Form 709 based on step-by-step instructions and practice pointers to minimize the mistakes

In this webinar, you will get to interact with and take insights from our taxation expert as to how you can prepare Form 709 without any errors. You will learn the basic difference between gift tax vs estate tax. We will provide a detailed review of the mistakes you can make in the process and show you the effective solutions to avoid them.

Above all, we will discuss the implications and penalties by the Internal Revenue Service (IRS) in this regard.

-Tax professionals

-Tax consultants

-Tax practitioners

-Estate attorneys

-Accountants

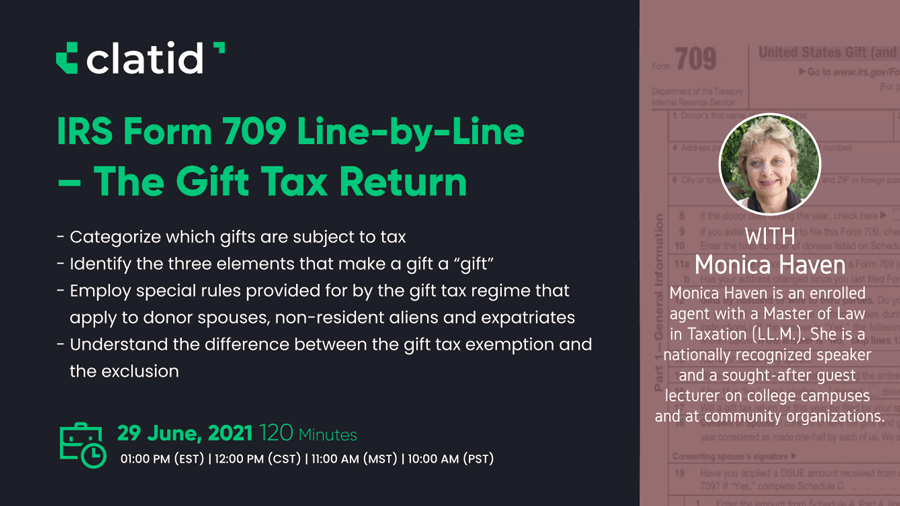

Monica Haven is an Enrolled Agent, an Accredited Tax Advisor, and Accredited Tax Preparer. With a Master of Law in Taxation (LL.M.) from Loyola Law School in Los Angeles, she has a Bachelor of Science degree in Small Business Management with an emphasis on New Ventures, and is a graduate fellow of the National Tax Practice Institute, a nationally recognized academic program designed to develop and hone the skills necessary for effective taxpayer representation.

Monica Haven has been a long-term and active member of numerous professional organizations, including the National Association of Enrolled Agents, the National Society of Accountants, the National Association of Tax Practitioners, the National Society of Tax Practitioners, the California Society of Enrolled Agents, the California Society of CPAs, and the California Society of Accounting and Tax Professionals, as well as the Los Angeles County Bar Association, the Young Tax Lawyers Committee, and the Tax Law Society.

She has been nominated to Who's Who in California, Who's Who of American Women, Two Thousand Notable American Women, International Who's Who of Professional and Business Women, World Who's Who of Women, and Woman of the Year in Finance.

She is a nationally recognized speaker and a sought-after guest lecturer on college campuses and at community organizations. She loves to teach and welcomes every opportunity to share her experience and expertise in the classroom, even as she maintains her Southern California tax practice which serves clients throughout the world. Monica’s students say she’s a “fantastic speaker” who can take “hard subjects and put them into concepts that are easy to understand.” She is “clear, articulate and expressive” and “has energy down to the last minute of the last class of the last day.” Let’s see if you agree.

Clatid Webinar Certification - Clatid rewards you with Clatid Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Clatid Courses and Webinar or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Clatid doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!