- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

Form 941 is the link between your payroll records and the IRS tax records. Proper administration of

this vital form is critical if you want to avoid IRS Notices and the penalties and interest that

accompany them. The Schedule B is also a crucial form for many employers. The IRS demands that

the Form 941 and the Schedule B match to the penny…every single time…without fail!

It has always been a requirement that the Forms 941 be reconciled with the Forms W-2 prior to

submitting each form. If the employer fails in this reconciliation, the IRS and Social Security

Administration can both assess penalties! This reconciliation has become even more critical these

past few years.

-For the attendee to understand the requirements for completing the latest version of the

2023 Form 941 correctly line by line.

-To ensure that the attendee has the basic knowledge to complete the Form Schedule B

according to the IRS regulations and to ensure that it reconciles down to the penny with the

Form 941 prior to submission.

-To ensure the attendee knows when a Form 941-X is required and provide the attendee with

the basic knowledge of how to complete Form 941-X.

-To demonstrate to the attendee the reconciliations needed under IRS and Social Security

Administration regulations.

-Line by line review of the 2023 Form 941 first quarter(Q1)

-Pending changes to the last and current quarter

-Tips for completing the Schedule B—liability dates vs. deposit dates

-Tips to balance Form 941 and Schedule B to the penny—as required by the IRS

-Form due dates

-Who should sign the Form 941

-Reporting third party sick pay, group term life insurance and tips correctly

-How to reconcile the Forms 941 with the Forms W-2

-What to do if you discover an error in deposits for the quarter when completing the Form

941

-Using the 941X form to correct the Form 941

This webinar covers the IRS Form 941 and its accompanying Form Schedule B for the first quarter of

2023. It discusses what is new for this version as well as the requirements for completing each form

line by line. It includes the filing requirements and tips on reconciling and balancing the two forms.

The webinar also covers the Forms used to amend or correct the returns.

-Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level

Personnel

-Human Resources Executives/Managers/Administrators

-Accounting Personnel

-Business Owners/Executive Officers/Operations and Departmental Managers

-Lawmakers

-Attorneys/Legal Professionals

-Any individual or entity that must deal with the complexities and requirements of Payroll

compliance issues

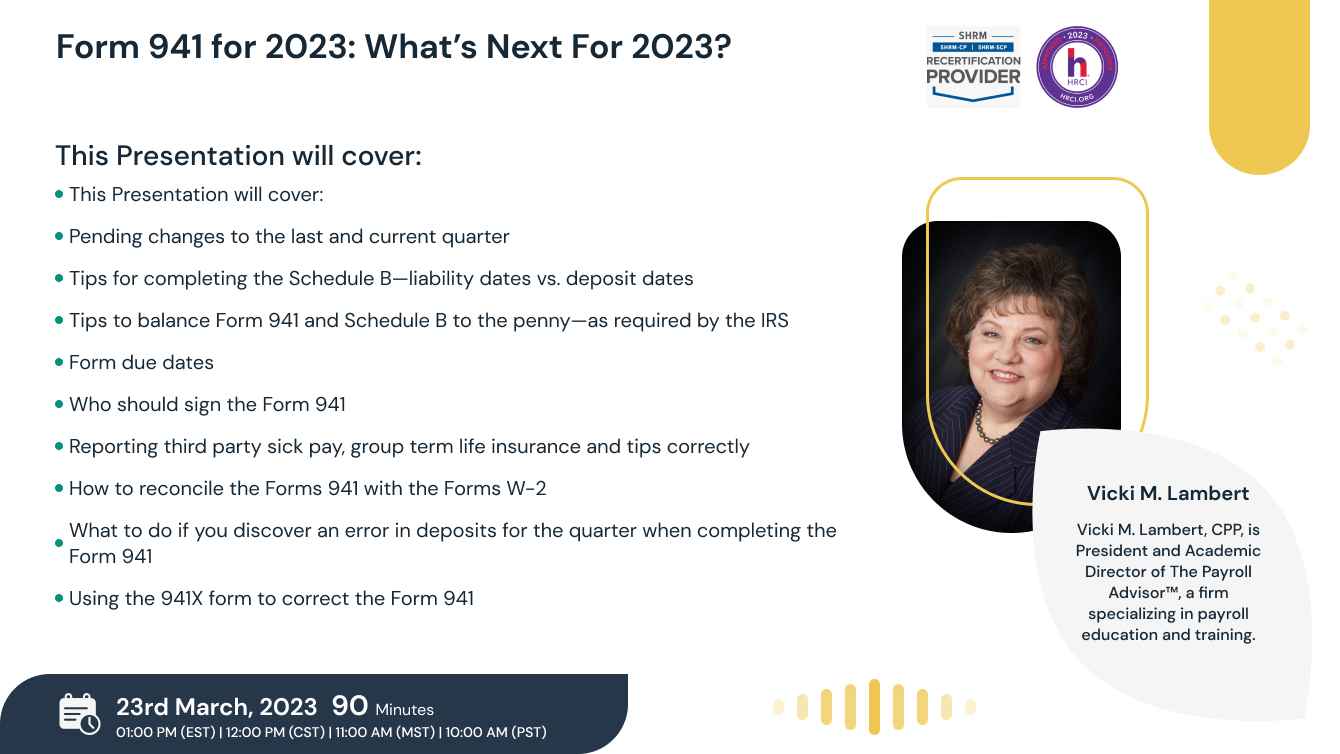

With nearly 40 years of hands-on experience in all facets of payroll

functions as well as over three decades as a trainer and author, Ms. Lambert

has become the most sought-after and respected voice in the practice and

management of payroll issues. She has

conducted open market training seminars on payroll issues across the United

States that have been attended by executives and professionals from some of the

most prestigious firms in business today.

A pioneer in electronic and online education, Ms.

Lambert produces and presents payroll-related audio seminars, webinars, and

webcasts for clients, APA chapters, and business groups throughout the country.

Ms. Lambert is an adjunct faculty member at Brandman University in Southern

California and is the creator of and instructor for their Practical Payroll

Online program, which is approved for recertification hours by the APA. She is

also the instructor for the American Payroll Association’s “PayTrain” online program

also offered by Brandman University.

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Clatid Webinar Certification - Clatid rewards you with Clatid Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Clatid Courses and Webinar or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Clatid doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!