- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

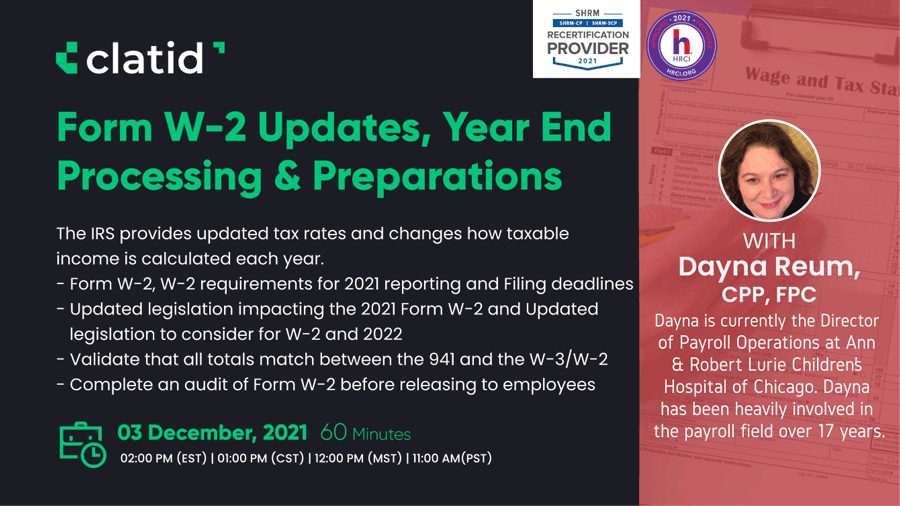

The IRS provides updated tax rates and changes how taxable income is calculated each year.

This year's changes will be more significant than in the past, due to Tax Reform. 2021 has seen additional updates employers and payroll departments need to know. The continued changes that affect the new Form W-4 and tax calculations in 2022 will be significant. This webinar will assist the seasoned payroll professional on new legislation that needs to be addressed.

This webinar will also assist the beginner around W-2 processing plus to better understand all the boxes on the Form W-2 and what should be reported. A brief overview of year-end and W-2 best practices will also be discussed. Updates on how to handle the SSN truncation especially for the states. Review of the reconciliation process for W-2’s considering the COVID-19 credits.

-Form W-2, W-2 requirements for 2021 reporting and Filing deadlines

-How to report FFCRA to leave on the W-2

-Form W-2 box by box review

-Understanding the new W-2 codes

-Understanding the changes to Social Security taxation

-State by State discussion of special W-2 considerations

-Complete an audit of Form W-2 before releasing it to employees

-Validate that all totals match between the 941 and the W-3/W-2

-Updated legislation impacting the 2021 Form W-2 and Updated legislation to consider for W-2 and 2022

-Year-End and W-2 best Practices to ensure compliance

-New Year legislation activity and new fringe benefit limits

By attending this webinar, you will get to learn about

-Form W-2 Reporting of FFCRA Qualified Leave and the extension of those credits into 2021

-How to handle the state requirements of the SSN truncation rules from the IRS on the Form W-2.

-Updates to how we process the W-2 form

-2021 W-2 updates

-Understanding when to check the status boxes for such things as retirement

-Details of how to close the 2021 year to make sure your W-2’s are correct and 941 reconciliation happens correctly.

-Review box by box of the W-2 and how tax reform has changed W-2 reporting.

-State-specific W-2 reporting and what you need to know

-All Employers

-Business Owners

-Company Leadership

-Payroll Tax Professionals

-Accounting Professionals

-HR Professionals

-Controllers

-Lawmakers

-Attorneys

-Any individual or entity that must deal with the complexities and requirements of Payroll compliance issues

Dayna is currently the Director of Payroll Operations at Ann & Robert Lurie Children’s Hospital of Chicago. Dayna has been heavily involved in the payroll field for over 17 years. Starting as a payroll clerk at a small Tucson company, Dayna moved on to be a Payroll Team Leader at Honeywell Inc. During Dayna’s time at Honeywell she obtained her FPC (Fundamental Payroll Certification) through the American Payroll Association. She also received several merit awards for Customer Service and Acquisitions and Divestitures.

Dayna is no stranger to teaching she has taught at the Metro Phoenix American Payroll Association meetings and at the Arizona State Payroll Conference. Topics including Payroll Basics, Global/Cultural Awareness, Immigration Basics for the Payroll Professional, Multi-State and Local Taxation and Quality Control for Payroll, International and Canadian payroll. Dayna has her CPP (Certified Payroll Professional) through the APA. She also serves on the National American Payroll Association on the National Strategic Leadership Task Force, Government Affairs Task Force (PA Local tax subcommittee). Dayna has received a Citation of Merit for her service along with being a Gold Pin member of the APA. Besides her payroll accomplishments, Dayna is certified in HR hiring and firing practices and is a Six-Sigma Greenbelt.

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Clatid Webinar Certification - Clatid rewards you with Clatid Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Clatid Courses and Webinar or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Clatid doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!