- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

Payroll departments submit and receive hundreds of thousands of bits of data each year. Employee master file data such as name and social security number, employee forms such the Form W-4, report to the IRS such as Form 941, state unemployment insurance quarterly returns, termination dates for employees, and even child support withholding orders.

Processing payroll comes with many challenges as well as benefits that most Employers aren't aware of. You need different payroll records that are required to process the payroll. Every type of record has different requirements of how long you must retain that record.

A critical question that every payroll professional must ask and more importantly answer is “What am I required to keep, in what format, and for how long”? The time over which payroll records must be retained will depend upon government requirements.

The Internal Revenue Service (IRS) typically states a required retention period in each document it issues dealing with payroll issues. In general, wage calculations should be retained for two years, while collective bargaining agreements should be retained for three years. Join us on Clatid to learn more about the States regulations and how you can ensure compliance in payroll in 2022.

We will go over the different types of documents that are considered payroll documents that must be maintained for a specific amount of time. Some forms you might not consider as payroll documents actually are.

Many states have different rules than the Federal regulations regarding these documents. We will touch on a few of these States and give guidance on how to find out more information about their regulations.

We will discuss each different type of document in regard to how long you are required to keep the documents. This includes timesheets, payroll changes, additions/deductions from Wages, State taxes, and many more.

-How long to keep each type of payroll document?

-Which documents are considered payroll documents?

-What are the specific State Laws regarding record retention?

-How to find details on the State Laws?

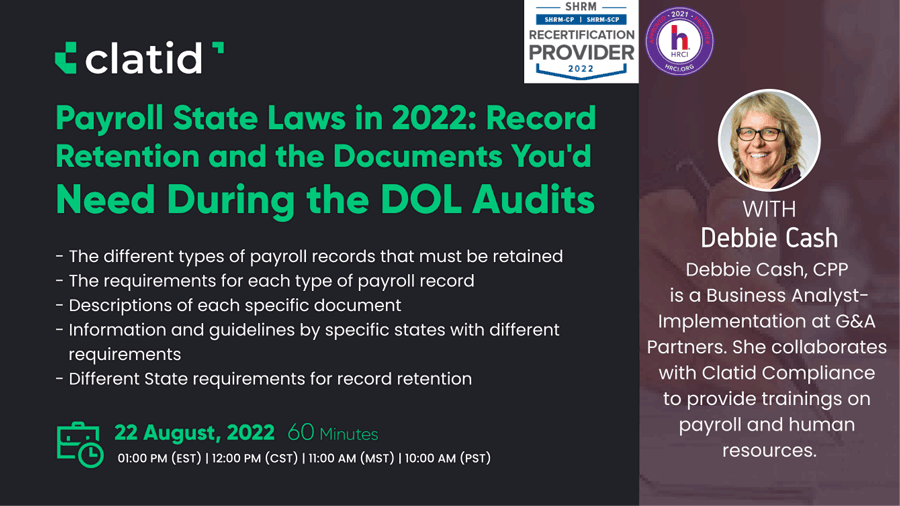

-The different types of payroll records that must be retained

-The requirements for each type of payroll record

-Descriptions of each specific document

-Information and guidelines by specific states with different requirements

-Different State requirements for record retention

Every company should be aware of how long to retain payroll documents. Being involved in a payroll or Department of Labor (DOL) audit is something no one wants to go through, and you never know when you will have to. Staying in compliance to keep these specific documents will make you more prepared should this ever happen.

When an audit happens if you don’t have the documents needed for the audit you could be assessed more fines and damages because of estimations of any findings the auditor did discover. Being sure you have what is needed to prove what was done will be better in all cases.

Staying in compliance is never easy but learning all you can about these regulations will better prepare you for any type of situation that could arise. Having these documents readily available for audits, employee reviews, and many other types of issues that arise in business will make these easier for all involved.

Payroll Professionals

Small Business Owners

Bookkeepers

Managers

Tax Professionals

Debbie Cash, CPP is a Business Analyst-Implementation at G&A Partners. She collaborates with Clatid Compliance to provide trainings on payroll and human resources. She was formerly a Payroll Tax/Time and Attendance Specialist at Employer Advantage LLC. G&A Partners is a Professional Employer Organization (PEO) that offers payroll, human resources, benefits management, risk management, and accounting services for businesses and they recently acquired Employer Advantage LLC a former PEO. She has been with the organization since 2006.

Debbie earned an associate's degree in Accounting from MSSU in 1985 and a bachelor's degree in General Business from MSSU in 2006. She obtained her Certified Payroll Professional Certification in October 2006. She has 30+ years of experience processing payroll and payroll taxes for various different companies and professions.

Debbie worked as a Payroll Specialist at Missouri Southern State University from 1993 to March 2006. She attended the International Tax Conference in Wisconsin in 2005 and specialized in International Tax for Student Visa’s. She also worked for Joplin R-8 School District from 1990 to 1993.

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Clatid Webinar Certification - Clatid rewards you with Clatid Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Clatid Courses and Webinar or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Clatid doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!