- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

Businesses can often find themselves with a payroll tax headache. To keep this from happening

you need to understand what can cause a payroll tax liability. Join us this April to learn the ways

an organization may find themselves owing payroll taxes that they thought they had filed

properly. It will provide tips on how to respond to notices and make claims for appeals to resolve

tax liabilities.

We will discuss the details of IRC Section 6672, the Trust Fund Recovery Penalty, and will

explain what it is and what it covers. We will discuss who is liable under the IRC Section 6672

and which taxes are covered under this code. Many people processing payroll taxes don’t

realize that they could be held responsible for these taxes if they aren’t filed properly. The

material covered in this session will give you the tools necessary to help your company remain

in compliance and avoid Payroll Tax Headaches. You will understand the types of

consequences and fines that could be assessed if you don’t properly pay these taxes.

Tips on how to make sure you are in compliance and keep yourself from receiving notices and

fines will be given. If you do find yourself receiving a notice, you will understand what to do next

and how to respond. Helpful websites and publications will be discussed along with other ways

to get help.

-What IRC Section 6672 is and how to keep in compliance to avoid it

-How to identify ways to avoid a payroll tax liability

-Guidance on how to respond to tax notices

-Valuable resources to keep in compliance

-How an Organization gets into a Payroll Tax Liability

-Precautions to take

-Types of Consequences

-IRC Section 6672-Trust Fund Recovery Penalities

-What to do when you receive a Notice

-Helpful websites

-Publications

-Ways to get help

Payroll Taxes are one thing that all businesses have in common. It is also one of the biggest

expenses for any business. Dealing with Payroll Tax Headaches can be overwhelming and

frustrating for any business. Failure to properly file and report payroll taxes can result in huge

fines and penalties for a business and may result in legal action. No business wants to receive

an order from the IRS or the State Government indicating they are being audited. They also

don’t want to receive notices of fines and penalties that could result in liens against the

company.

This topic will give you guidance on precautions to take to keep from getting into a Payroll Tax

Liability. It will provide tips on how to respond to notices and make claims for appeals to resolve

tax liabilities. We will discuss the details of IRC Section 6672, the Trust Fund Recovery Penalty,

and will explain what it is and what it covers. We will discuss who is liable under the IRC Section

6672 and which taxes are covered under this code. The material covered in this session will

provide you with the tools necessary to help your business remain in compliance and avoid

Payroll Tax Headaches.

-Payroll Professionals

-Owners

-Tax Professionals

-Bookkeepers

-Managers

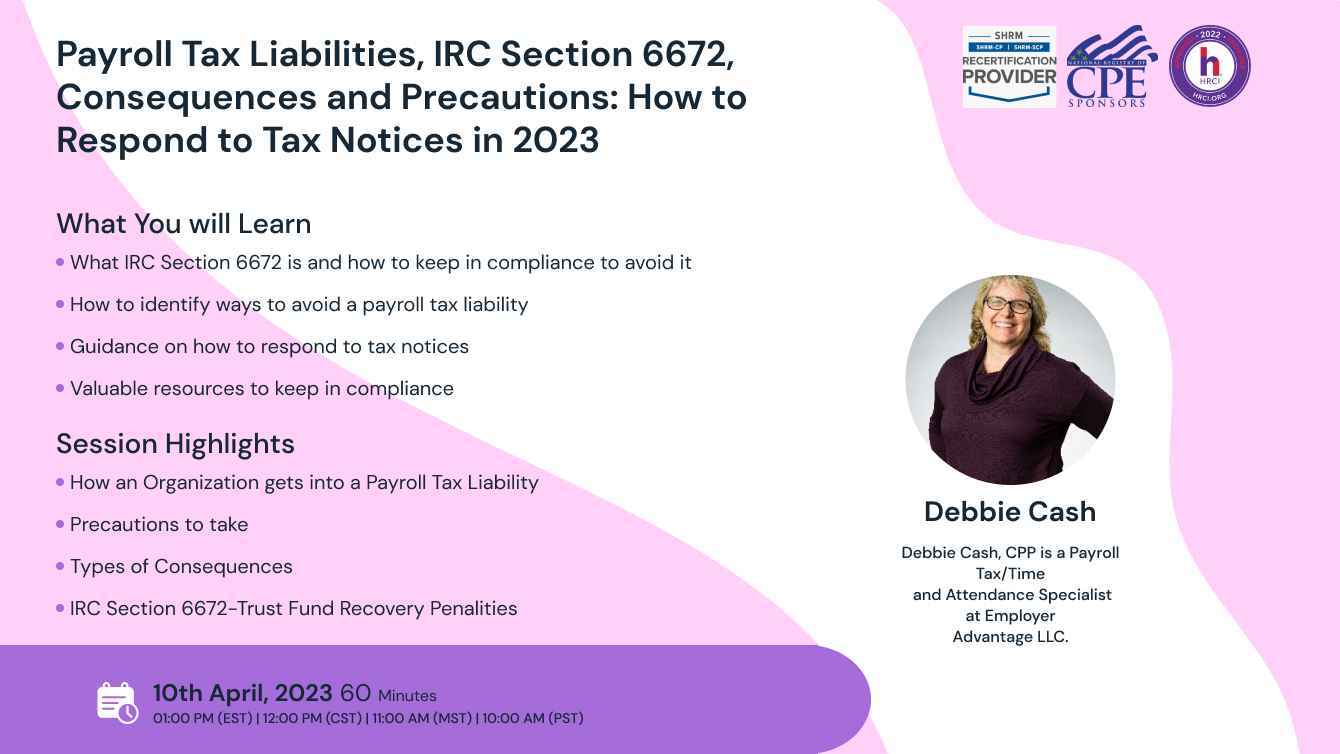

Debbie Cash, CPP is a Business Analyst-Implementation at G&A Partners. She collaborates with Clatid Compliance to provide trainings on payroll and human resources. She was formerly a Payroll Tax/Time and Attendance Specialist at Employer Advantage LLC. G&A Partners is a Professional Employer Organization (PEO) that offers payroll, human resources, benefits management, risk management, and accounting services for businesses and they recently acquired Employer Advantage LLC a former PEO. She has been with the organization since 2006.

Debbie earned an associate's degree in Accounting from MSSU in 1985 and a bachelor's degree in General Business from MSSU in 2006. She obtained her Certified Payroll Professional Certification in October 2006. She has 30+ years of experience processing payroll and payroll taxes for various different companies and professions.

Debbie worked as a Payroll Specialist at Missouri Southern State University from 1993 to March 2006. She attended the International Tax Conference in Wisconsin in 2005 and specialized in International Tax for Student Visa’s. She also worked for Joplin R-8 School District from 1990 to 1993.

SHRM-

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM.

This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

NASBA-

Clatid is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!